wisconsin car sales tax calculator

In Wisconsin the state sales tax rate of 5 applies to all car sales. 16450 for an original title or title transfer.

Sales Taxes In The United States Wikiwand

425 motor vehicle document fee.

. Wisconsin has 816 special sales tax jurisdictions with local sales taxes in. Your household income location filing status and number of personal exemptions. Vehicle Registration Tax Calculator.

The baseball stadium district tax will end in 2020. There may be additional local sales tax depending on your county or city. Wisconsin car tax is 227145 at 550 based on an amount of 41299 combined from the sale price of 39750 plus the doc fee of 249 plus the extended warranty cost of 3500 minus the trade-in value 2200.

The state use tax rate is 5 and if the item purchased is used stored or consumed in a county that imposes county tax you must also pay an additional 05 county tax. The date that you purchased or plan to purchase the vehicle. View pg 1 of chart find total for location.

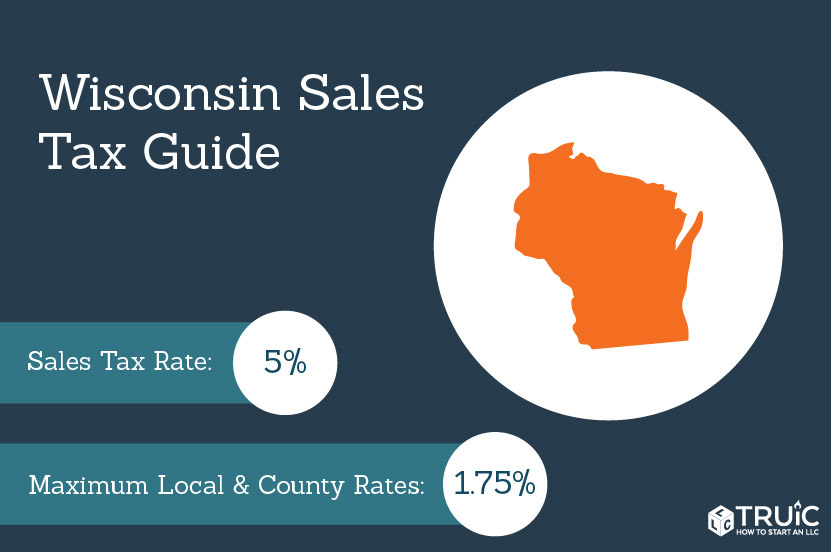

The average Wisconsin car sales tax including state and county rates is 5481. Users can tell at a glance how much of the total figure consists of various taxes and fees which are. Wisconsin has a 5 statewide sales tax rate but also has 265 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 046 on top.

Wisconsin has recent rate changes Wed Apr 01 2020. Try our FREE income tax calculator. Our free online Wisconsin sales tax calculator calculates exact sales tax by state county city or ZIP code.

Last day is March. The information you may need to enter into the tax and tag calculators may include. Well review the vehicle property tax for each state in the table below.

This tool will help you calculate the fees that Wisconsin drivers pay each year compared to drivers in other Midwest states. Finally click on Calculate or not our calculator doesnt even require your action it. Wisconsin DMV fees are about 318 on a 39750 vehicle based on a combination of flat fees that vary by.

TAX DAY NOW MAY 17th - There are -357 days left until taxes are due. Local taxes of 05 are collected in 68 Wisconsin counties. With local taxes the total sales tax rate is between 5000 and 5500.

Groceries and prescription drugs are exempt from the Wisconsin sales tax. The title fee is 6950. See the total sales and use tax rate for each county.

Standard fees charged by the state when purchasing a new vehicle in Wisconsin are. Wisconsin collects a 5 state sales tax rate on the purchase of all vehicles. Staying within budget when youre car shopping doesnt have to be difficult if you know what.

In addition to taxes car purchases in Wisconsin may be subject to other fees like registration title and. The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. Wisconsin Used Car Sales Tax Calculator.

The date the vehicle entered or will enter the state you plan to register it in. The vehicle identification number VIN. 65 county city rate on 1st 2500.

The total tax rate also depends on your county and local taxes which can be as high as 675. If for example you pay a 10 sales tax on 20000 thats an additional 2000 you must spend. There are also county taxes of up to 05 and a stadium tax of up to 01.

You have a camera shipped to your home in Dane County. The tool then generates a colorful chart with the estimated annual cost of driving that car in Wisconsin Illinois Iowa Michigan and Minnesota. To know what the current sales tax rate applies in your state ie.

Enter the Amount you want to enquire about. 56 county city. The state sales tax rate in Wisconsin is 5000.

Mortgage Loan Auto Loan Interest Payment Retirement Amortization Investment Currency Inflation Finance Mortgage Payoff Income Tax Compound Interest. Select Community Details then click Economy to view sales tax rates. Additional fees apply to alternative fuel vehicles to file a lien on the car temporary plates and the registration fee.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. The calculator includes dozens of popular vehicles and WisDOT will soon add additional models. The statewide sales tax in Wisconsin is 5.

Contact your states department of motor vehicles dmv to determine. Before-tax price sale tax rate and final or after-tax price. There will be state sales tax charged on the amount of cash you paid for the car minus the trade-in value.

Some dealerships also have the option to charge a dealer service fee of 99 dollars. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Net price is the tag price or list price before any sales taxes are applied.

Counties and cities can charge an additional local sales tax of up to 06 for a maximum possible combined sales tax of 56. The make model and year of your vehicle. The Wisconsin state sales tax rate is 5 and the average WI sales tax after local surtaxes is 543.

Start filing your tax return now. Premier resort area tax rental vehicle fee etc. The combined rate used in this calculator 55 is the result of the Wisconsin state rate 5 the 53955s county rate 05.

Note that while tax title and license fees can differ based on the type of vehicle being purchased weve compiled the ones that can be expected when purchasing and owning a. In addition there may be county taxes of up to 05 along with a stadium tax of up to 01. Sales and environmental taxes and fees levied on gasoline plus vehicle registration renewal fees as of January 1 2021.

The national average state and local sales tax by. The kenosha wisconsin general sales tax rate is 5the sales tax. Wisconsin State County and Stadium Sales Tax Rate Look-Up You may use this lookup to determine the Wisconsin state county and baseball stadium district sales tax rates that apply to a location in Wisconsin.

Also called manufactured homes mobile homes used as a dwelling receive a 35 sales tax exemption which means the remaining 65 is taxed at the full sales tax rate. Choose the Sales Tax Rate from the drop-down list. The table below shows the sales.

Wisconsin all you need is the simple calculator given above. With local taxes the total sales tax rate is between 5000 and 5500. Finally to address potential wheel tax select the municipality and county you live in.

2000 x 5 100.

Gross Capitalized Cost Lease Calc Worksheet 9 13 Rev

State Income Tax Rates Highest Lowest 2021 Changes

Lowest Tax Rates Anderson Auto Group

Wisconsin Car Registration Everything You Need To Know

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Dmv Fees By State Usa Manual Car Registration Calculator

What S The Car Sales Tax In Each State Find The Best Car Price

How Much Are Tax Title And License Fees In Wisconsin

Vehicle Sales Tax Deduction H R Block

States With Highest And Lowest Sales Tax Rates

Wisconsin Sales Tax Small Business Guide Truic

Capital Gains Tax Calculator 2022 Casaplorer

Trade In Sales Tax Savings Calculator Find The Best Car Price

Calculate The Sales Taxes In The Usa For 2022 Credit Finance

Car Sales Tax In Wisconsin Getjerry Com

How To Calculate Sales Tax Video Lesson Transcript Study Com