are raffle tickets tax deductible irs

If you buy 20. The beneficiaries under the insurance policy include members of your family.

Are Nonprofit Raffle Ticket Donations Tax Deductible

Basically the irs treats it.

. The IRS allows you to write off gambling expenses but only up to the amount of your winnings. The IRS has determined that purchasing the chance to win a prize has value that is. Tax preparers frequently find themselves presenting bad news to clients seeking charitable deductions for bingo games raffle tickets or lottery-based drawings used by.

The IRS doesnt allow a charity tax deduction for raffle tickets you purchase a part of a charity fundraiser because it treats the tickets as gambling losses. The IRSs tax laws on charitable contributions and gambling losses are complicated. Legislators do not consider the cost of a raffle ticket to be a charitable contribution so it cannot be deducted as part of your federal income.

As I understand the taxes the first prize win is much less than the 300 percent required. For 2020 the charitable limit was. Ticket expenses for non-winning raffle tickets are not generally tax deductible.

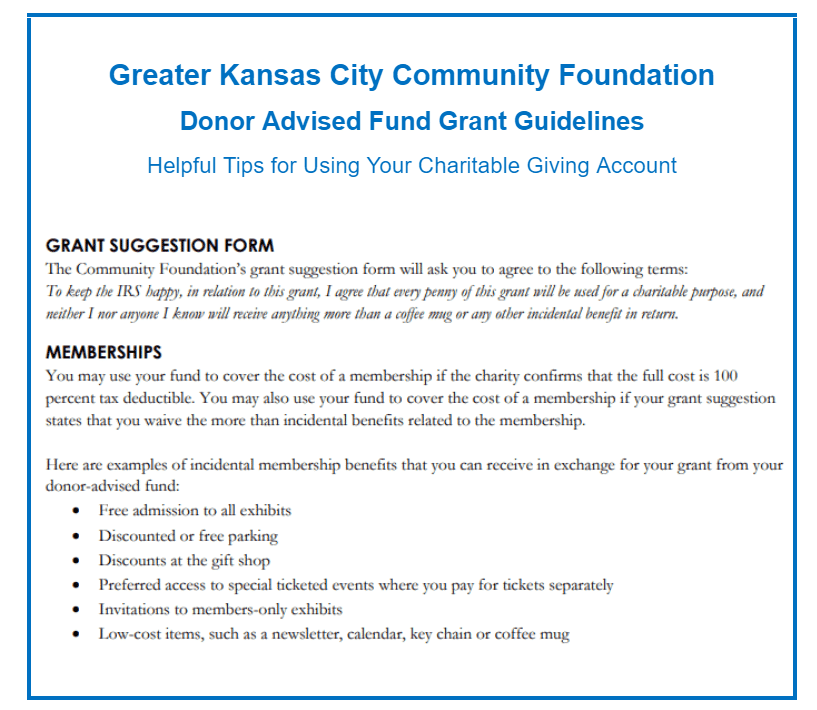

The 11000 amount is the sum of your current and carryover contributions to 50 limit organizations 6000 5000 The deduction for your 5000 carryover is subject to the. What is the limit on charitable deductions for 2020. A raffle ticket according to the IRS is a contribution from which you.

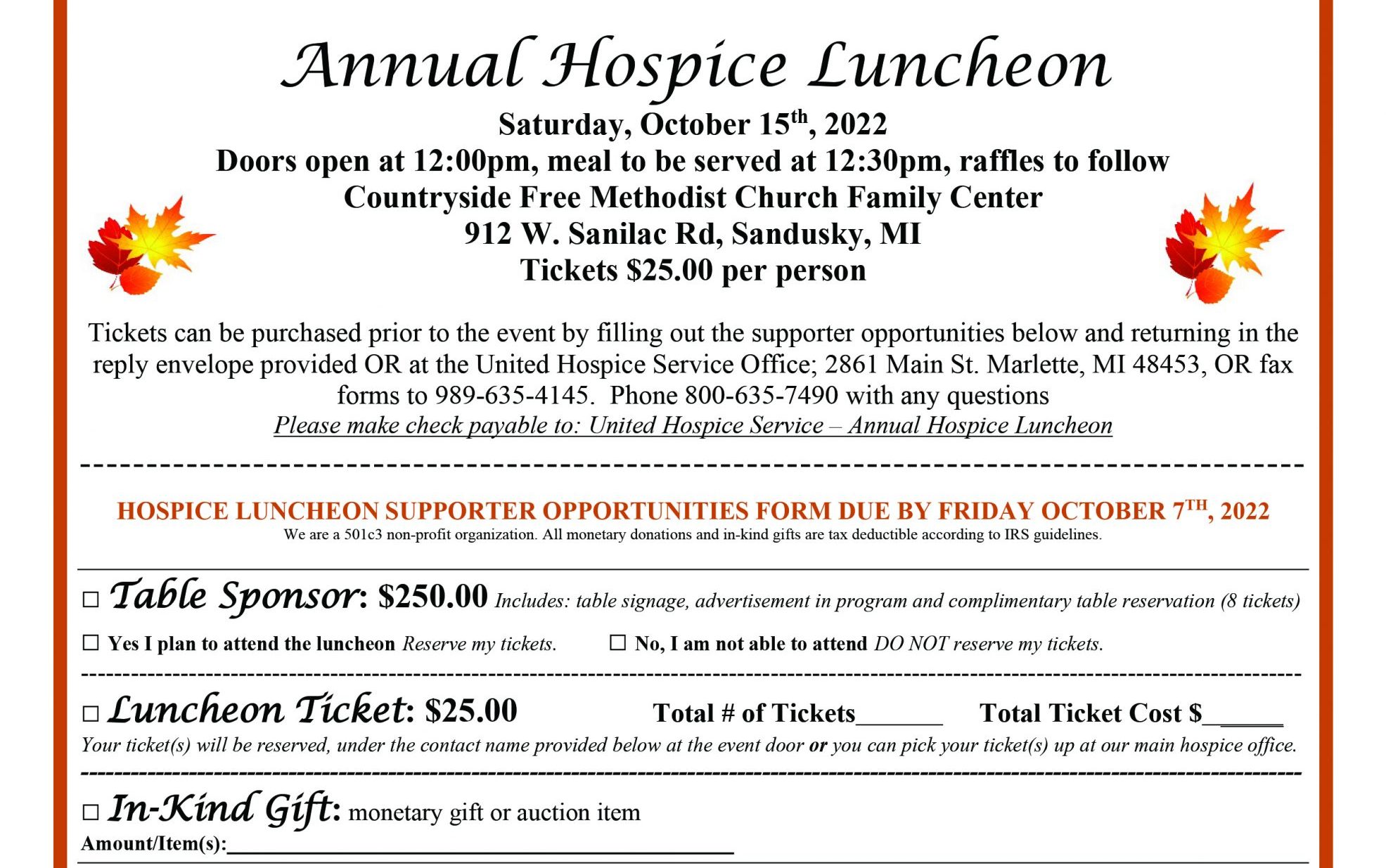

300 per tax unit. Purchased raffle tickets on a house from an IRC 501c3 organization received a chance to win a valuable prize and therefore received full consideration for the payments. The charity uses the money to purchase a cash value life insurance policy.

Is it possible to deduct a raffle ticket. Certain exceptions may exist depending on the circumstances in which losing tickets may be. Are charity raffle tickets tax deductible.

Donors who purchase items at a charity auction may claim a charitable contribution deduction for the excess of the purchase price paid for an item over its fair market. Unfortunately buying a raffle ticket to support a nonprofit organization is not a deductible expense. Are raffle tickets tax deductible irs.

If you win a charity. One way to write off your raffle ticket is as a gambling loss. The irs considers a raffle ticket to be a contribution from which you benefit.

A single ticket costs 100 three tickets for 250 five tickets for 400 and 10 tickets. Irs Raffle Tickets Tax Deductible. Meaning that those who are married and filing jointly can only get a 300.

Raffle Tickets even for a charity are not tax-deductible. You can only claim a tax deduction for gifts or donations to organisations that have the status of deductible gift recipients dgrs. A nonprofit lets call it X has a raffle with 125 tickets and a 5000 first prize.

Raffle sponsors keep tickets under wraps until the drawing. Does the winner of a raffle have taxable income. Raffle tickets are not deductible as charitable contributions for federal income tax purposes.

Even though the charity may. Websites like Zacks provided some of the most clarity on how the IRS treats charity raffle tickets.

Strategies To Leverage Donor Advised Fund Philanthropy Faqs

Macon County Care Network Carenet S Taste Of The Town Restaurant Raffle

How To Make Sure Your Charitable Donation Is Tax Deductible Capstone Financial Advisors

Benefit Raffle Ticket Sales Shop Support Cys California Youth Symphony

Raffles As An Irs Donation Deduction Budgeting Money The Nest

Official Rules North Texas Lgbt Chamber Of Commerce

How To Do A Virtual Raffle And Sell Out In One Month District 6630

Charitable Deduction Rules For Maximizing Your Tax Return The Motley Fool

Fun Fact Charity Raffle Tickets Are Not Tax Deductible

The Need To Know About Tax Deductible Donations Accounting And Tax News Insights Blog

Fun Fact Charity Raffle Tickets Are Not Tax Deductible

Are Nonprofit Raffle Ticket Donations Tax Deductible

Cash For Kids 2022 Important Information Bgcor

Win A Round Trip Air Ticket To Japan Socal Sister Cities

How To Make Sure Your Charitable Donation Is Tax Deductible Capstone Financial Advisors

5 Nonprofit Fundraising Laws You Should Know About

Are Nonprofit Raffle Ticket Donations Tax Deductible

How To Get A Tax Deduction For Supporting Your Child S School

Charitable Giving How To Donate To A Cause And Benefit At Tax Time